Ten days have passed since a vile act of harassment shook the United Federation of Teachers’ headquarters at 52 Broadway, Manhattan, and the silence from UFT leadership is deafening.

Laminated cards bearing Amy Arundell’s face, a respected union figure, with the grotesque phrase “Piss on My Face,” were plastered in the men’s urinals during a June 2025 delegate assembly. When Amy's (many) allies personally removed them, they were replaced -'meaning this wasn't a joke. It was premeditated hate" (here).

This disgusting display wasn’t just an attack on one woman—it was a slap in the face to every female teacher who looks to the UFT for protection and respect. Yet, the UFT has failed to name the culprit or offer a public apology or even publicly reassure other women in their union, leaving women teachers questioning their union’s commitment to their dignity.

In fact, the only public reply from the UFT at all came from their political arm, UFTUnity. It came from a union leader named Adam Shapiro and it was a pathetic attempt at victim blaming.

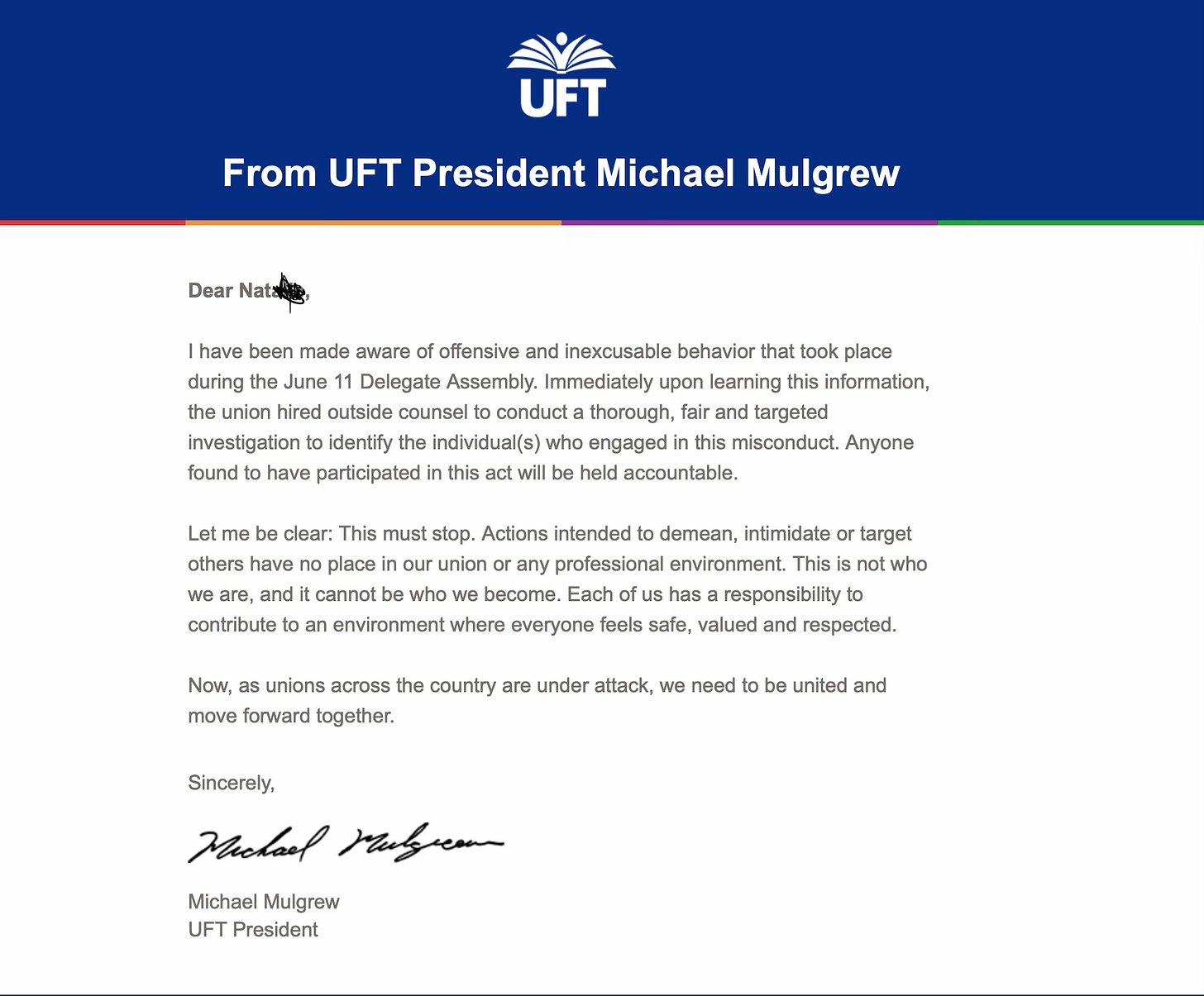

The UFT did hire an outside law firm to investigate, and Arundell filed a harassment complaint with the NYPD. But investigations alone don’t heal wounds or rebuild trust. By not publicly addressing this outrage or apologizing to Arundell and all women in the union, the UFT is permitting this offense to linger.

They’re doing this on purpose, of course, so that the offense continues to linger. They are doing this because not apologizing is literally all they can do to cause and to create more harm to Amy and to the nearly one third of their own members who wanted her, not them, to lead us.

I know many of these people; I know how they think. This is the type of disgusting, human beings they can be. This silence is them without the mask. You’re watching more quiet abuse play out in real time. The silence is the abuse. It lies in not apologizing and not reassuring other women in the union that they will not suffer the same fate. It lies in leadership not taking public steps to ensure they will not suffer the same experience. This is their way of quietly saying “fuck you” one more time to their colleague and former thought leader Amy Arundell. This is them. This is the real them. Watch their continued efforts to be silent and see the real people who lead the UFT.

You should demand the UFT issue a public apology to Amy Arundell and all women teachers. Demand it pledge -openly and unequivocally- to foster an environment where no woman faces such vile treatment again. This isn’t negotiable—it’s a moral imperative. Women teachers aren’t just union members; they are the backbone of our schools. If you don’t demand, it will never offer one and the backbone of schools to will carry on -with the message that they will be marginalized if ever they dare to be a leader again.

When they are not dancing on their beds for insta likes or misleading members into thinking that paras are about to get a floor vote (or running to the UFT general counsel with the name on phone number of every pseudonym they can get their hands on) they are actually quite selfish and self centered people. Please know, they will simply ignore this if you let them. They will only act honestly with public pressure. But if you demand a public apology then they will give one. If you don't you will see how they pretend this never happened and then marginalize the event and the harm.

Arthur Goldstein once wrote that rights are tricky things: If you don’t use them, they don’t exist. I have a weird belief that a women’s right to equality in the workplace is absolute. You don’t have to have that weird belief if you don't want to but everyone has the right to not be humiliated in the workplace. They can not like her. That is their choice. They can't cause harm to her or her reputation because of it. That is unethical. It is illegal. It is immoral.

Need more convincing? Stop listening to the words of the UFT leaders. Start watching their actions. Start now, here with this issue. They have not apologized in 10 days. That is the sum of their actions around this. Compel them to act better by demanding an apology and a public reassurance to all teachers of the city that women will not be treated this way again in their union building.